Annual Look at Database Trends (Jan 2024)

Each January I take a little time to look back on the Database market over the previous calendar year. This year I’ll have a look at 2023 (obviously!) and how things have changed and evolved.

In my post from last year (click here) I mentioned the behaviour of some vendors and how they like to be-little other vendors. That kind of behaviour is not really acceptable, but they kept on doing it during 2023 up to a point. That point occurred during the Autumn of 2023. It was during this period there was some degree of consolidation in the IT industry with staff reductions through redundancies, contracts not being renewed, and so on. These changes seemed to have an impact on the messages these companies were putting out and everything seemed to calm down. These staff reductions have continued into 2024.

The first half of the year was generally quiet until we reached the Summer. We then experienced a flurry of activity. The first was the release of the new SQL standard (SQL:2023). There were some discussions about the changes included (for example Property Graph Queries), but the news quickly fizzled out as SQL:2023 was primarily a maintenance release, where the standard was catching up on what many of the database vendors had already implemented over the preceding years. Two new topics seemed to take over the marketing space over the summer months and early autumn. These included LLMs and Vector Databases. Over the Autumn we have seen some releases across vendors incorporating various elements of these and we’ll see more during 2024. Although there have been a lot of marketing on these topics, it still remains to be seen what the real impact of these will be on your average, everyday type of enterprise application. In a similar manner to previous “new killer features” specialised database vendors, we are seeing all the mainstream database vendors incorporating these new features. Just like what has happened over the last 30 years, these specialised vendors will slowly or quickly disappear, as the multi-model database vendors incorporate the features and allow organisations to work with their database rather than having to maintain several different vendors. Another database topic that seemed to attract a lot of attention over the past few years was Distributed SQL (or previously called NewSQL). Again some of the activity around this topic and suppliers seemed to drop off in the second half of 2023. Time will tell what is happening here, maybe it is going through a similar time the NewSQL era had (the previous incarnation). The survivors of that era now call themselves Distributed SQL (Databases), which I think is a better name as it describes what they are doing more clearly. The size of this market is still relatively small. Again time will tell.

There was been some consolidation in the open source vendor market, with some mergers, buyouts, financial difficulties and some shutting down. There have been some high-profile cases not just from the software/support supplier side of things but also from the cloud hosting side of things. Not everyone and not every application can be hosted in the cloud, as Microsoft CEO reported in early 2023 that 90+% of IT spending is still for on-premises. We have also seen several reports and articles of companies reporting their exit from the Cloud (due to costs) and how much they have saved moving back to on-premises data centres.

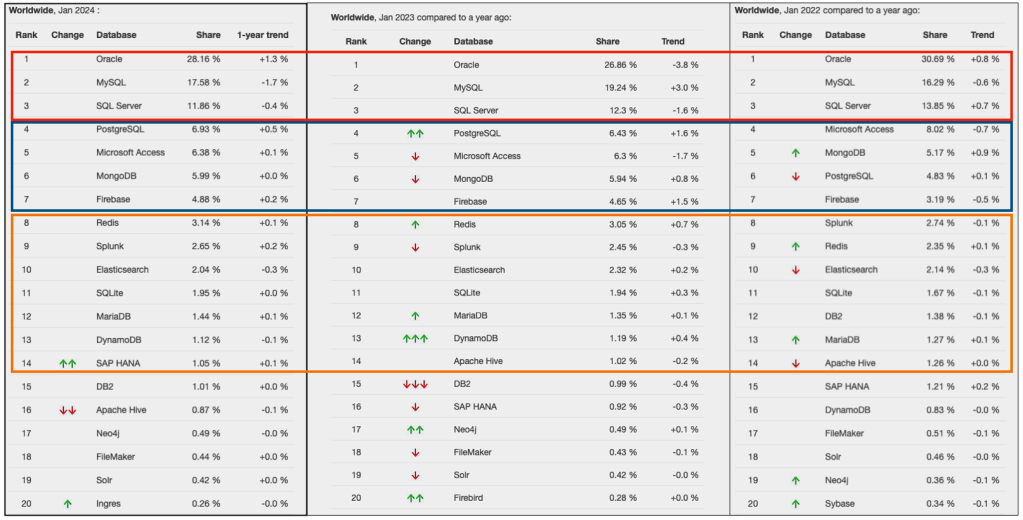

Two popular sites that constantly monitor the wider internet and judge how popular Databases are globally. These sites are DB-Engines and TOPDB Top Database index. These are well-known and are frequently cited. The image below, based on DB-Engines, shows the position of each Database in the top 20 and compares their position changes to 12 months previously. Here we have a comparison for 2023 and 2022 and the changes in positions. You’ll see there have been no changes in the positions of the top six Databases and minor positional changes for the next five Databases.

Although there has been some positive change for Postgres, given the numbers are based on log scale, this small change is small. The one notable mover in this table is Snowflake, which isn’t surprising really given what they offer and how they’ve been increasing their market share gradually over the years.

The TOPDB Top Database Index is another popular website and measures the popularity of Databases. It does this in a different way to DB-Engines. It can be an interesting exercise to cross-compare the results between the two websites. The image below compares the results from the past three years from TOPDB Top Database Index. We can see there is very little difference in the positions of most Databases. The point of interest here is the percentage Share of the top ten Databases. Have a look at the Databases that changed by more than one percentage point, and for those Databases (which had a lot of Marketing dollars) which moved very little, despite what some of their associated vendors try to get you to believe.